Interpretation of the Emerging Accounting Issues (E) Working Group INT 08-10: Contractual Terms of Investments and Investor Inte

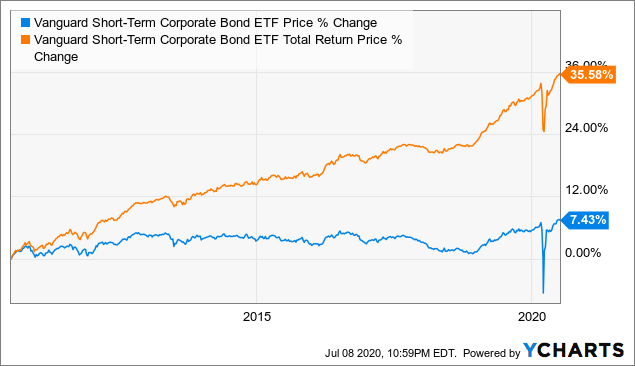

Vanguard Short-Term Corporate Bond ETF Is A Better Choice Than U.S. Treasuries (NASDAQ:VCSH) | Seeking Alpha

Amazon.com: Debt Maturity and the Use of Short-Term Debt eBook : Chen, Sophia, Ganum, Paola, Liu, Lucy Qian, Martinez, Leonardo, Martinez Peria, Maria Soledad: Books

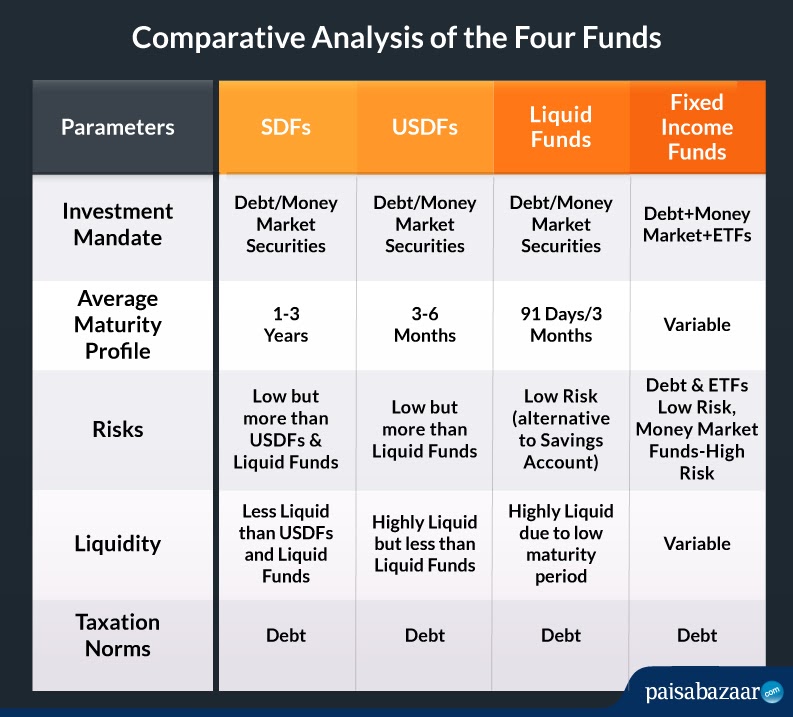

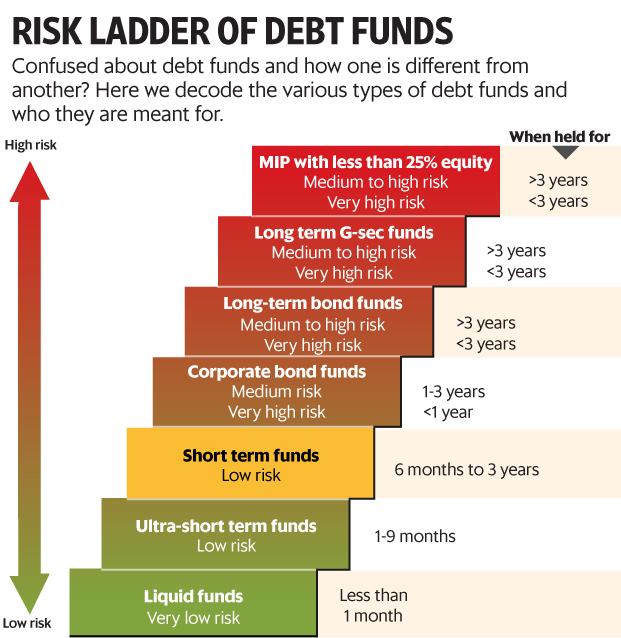

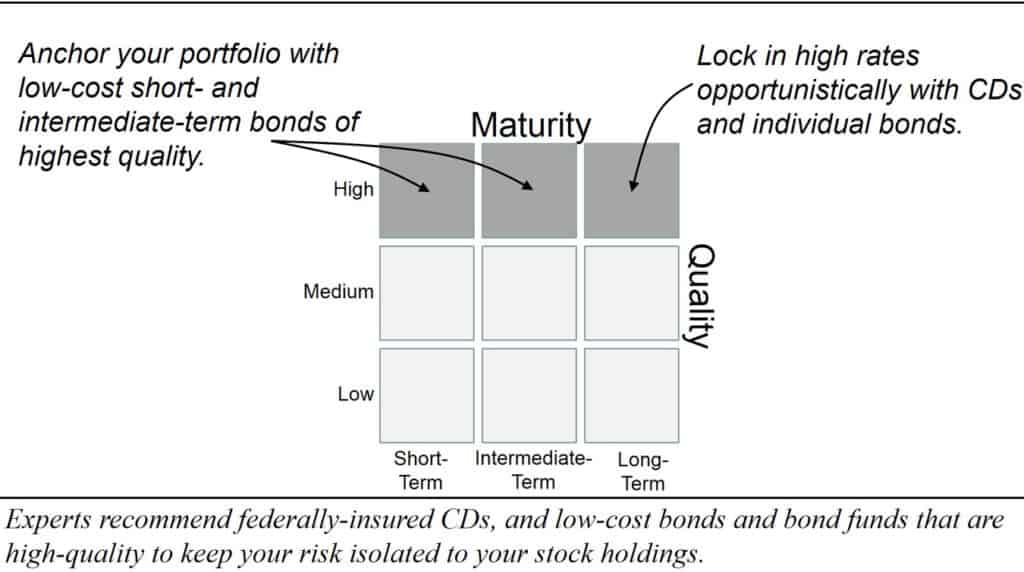

Mutual Funds – Short-Term Bond Funds Can Help Maintain Your Asset Allocation – kesari financial services

Sources of Short-Term Financing (Chapter 8) (Chapter 6 – pages 151 – 155) Short-Term Vs. Long-Term Financing Approaches to Financing Policy Trade Credit. - ppt download

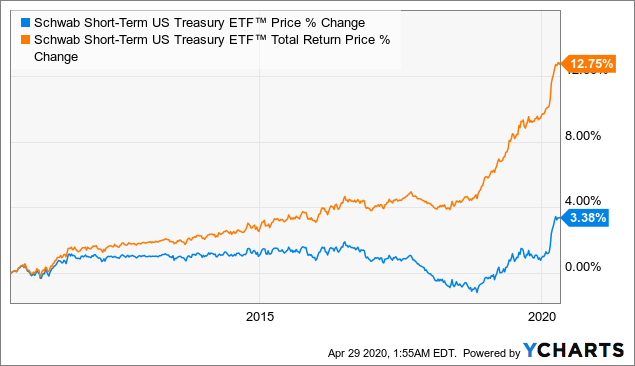

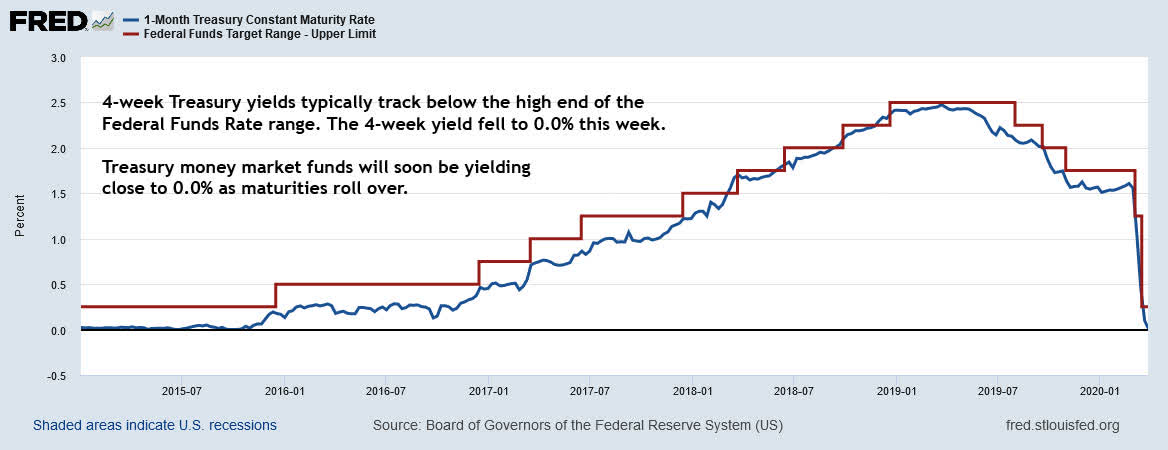

Schwab Short-Term U.S. Treasury ETF: A Stable Fund With Low Volatility (NYSEARCA:SCHO) | Seeking Alpha

:max_bytes(150000):strip_icc()/invertedyieldcurve_final-25d38e62233047bd9507553337f4413d.png)

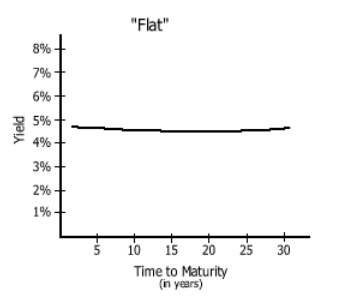

:max_bytes(150000):strip_icc()/YieldCurve2-362f5c4053d34d7397fa925c602f1d15.png)